Welcome to the world of financial modeling in Excel, where the right formulas can transform complex data into actionable insights. Whether you’re a finance professional, business owner, or aspiring analyst, these top 10 financial tricks will elevate your Excel game and simplify your financial tasks.

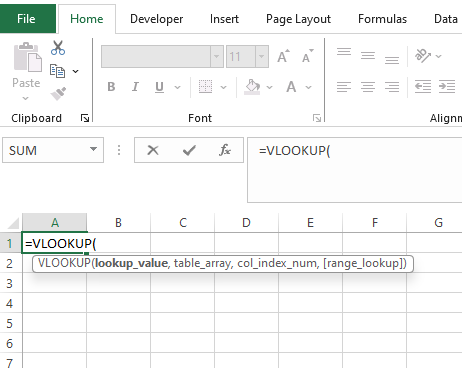

1. VLOOKUP: Your Data Navigation Ace

The VLOOKUP function is your go-to tool for quick data retrieval. Imagine having a massive dataset, and you only need specific information. With VLOOKUP, you can swiftly fetch relevant financial data based on a unique identifier.

Formula Usage:

=VLOOKUP(lookup_value, table_array, col_index_num, [range_lookup])Purpose:

- Quick data lookup and extraction.

- Efficient reconciliation of transactions.

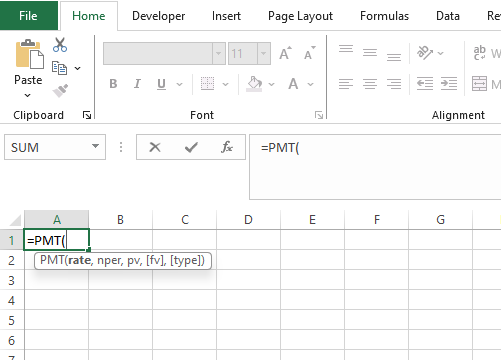

2. PMT Function: Navigating Loan Payments

When dealing with loans, the PMT function becomes your best friend. It calculates the monthly payment amount for a loan, simplifying financial planning and budgeting.

Formula Usage:

=PMT(rate, nper, pv, [fv], [type])Purpose:

- Calculate monthly loan payments.

- Plan and budget effectively.

See Interest Rate Calculator with Loan Aortization schedule sheet

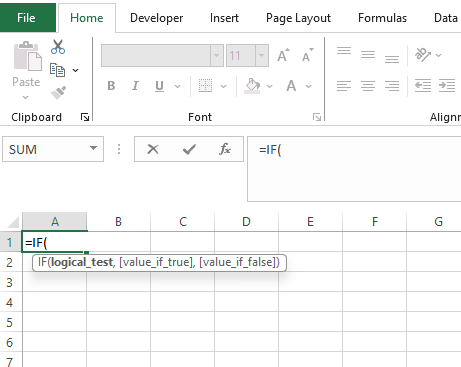

3. IF Statements: Logic at Your Fingertips

Introduce conditional logic into your financial models with IF statements. Automate decision-making processes based on specific criteria, making your models dynamic and responsive.

Formula Usage:

=IF(logical_test, [value_if_true], [value_if_false])Purpose:

- Automate decision-making in financial models.

- Handle scenarios with different outcomes.

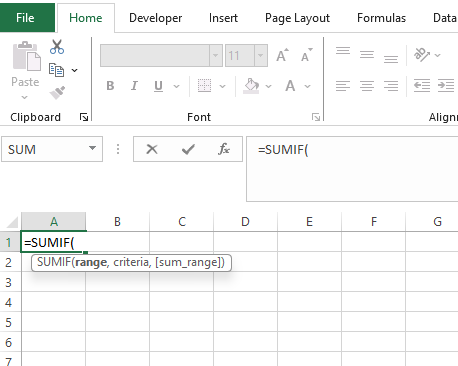

4. SUMIF: Conditional Summation Magic

When you need to sum values based on a specified condition, turn to SUMIF. This formula is a game-changer for tasks like budgeting and expense tracking.

Formula Usage:

=SUMIF(range, criteria, [sum_range])Purpose:

- Sum data points based on specific conditions.

- Simplify budgeting and tracking tasks.

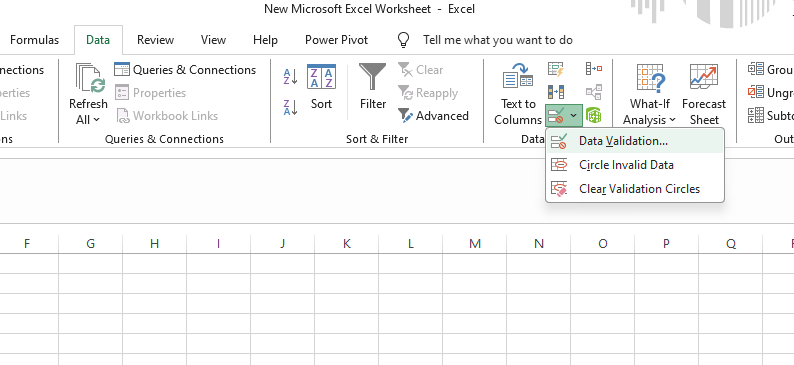

5. Data Validation: Error-Proof Your Data Entry

Data validation ensures that your financial models remain error-free. Implement this feature to restrict users to inputting only valid data, maintaining the integrity of your data.

Implementation:

- Select cells

- Go to Data > Data Tools > Data Validation

Purpose:

- Minimize errors in financial models.

- Ensure data accuracy.

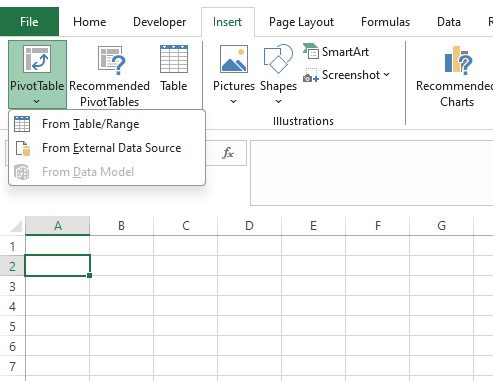

6. PivotTables: Dynamic Data Analysis

PivotTables are

dynamic data analysis tools. Use them to summarize and analyze large datasets quickly, providing valuable insights for financial reporting.

Purpose:

- Summarize and analyze large datasets.

- Enhance financial reporting.

7. INDEX and MATCH Combination: Flexibility Unleashed

For more flexibility in lookups, ditch VLOOKUP and embrace the INDEX and MATCH combination. This duo allows for both vertical and horizontal lookups.

Formula Usage:

=INDEX(return_range, MATCH(lookup_value, lookup_range, 0))Purpose:

- Flexible lookup options.

- Improved accuracy in data retrieval.

8. Scenario Manager: Navigate What-If Analysis

The Scenario Manager empowers you to create and compare different scenarios in your financial model. Perfect for exploring various outcomes based on changing inputs.

Implementation:

- Go to Data > What-If Analysis > Scenario Manager

Purpose:

- Conduct What-If analysis.

- Evaluate multiple scenarios for decision-making.

9. Conditional Formatting: Visual Insights at a Glance

Conditional Formatting visually enhances your financial reports. Use it to highlight trends, outliers, or specific data points, making your data more interpretable.

Implementation:

- Select cells

- Go to Home > Conditional Formatting

Purpose:

- Improve data interpretability.

- Highlight key trends and outliers.

10. Goal Seek: Achieve Your Financial Targets

When you have a financial goal in mind, use Goal Seek to find the input value needed to achieve that target. This is particularly useful for budgeting and financial planning.

Implementation:

- Go to Data > What-If Analysis > Goal Seek

Purpose:

- Set and achieve specific financial targets.

- Plan effectively for the future.

Conclusion: Excel Mastery Unveiled

Congratulations! With these top 10 financial tricks in your Excel toolkit, you’re well on your way to mastering financial modeling. Whether you’re calculating loan payments, analyzing large datasets, or planning for the future, these formulas and tricks will streamline your tasks and enhance your financial expertise. Start incorporating them into your financial models today, and watch your efficiency soar. Happy modeling! 🚀📊

Leave a Reply